Short Calendar Spread – The short call spread (or “bear call spread”) is a strategy employed by traders who expect a stock to move sideways, or decline slightly, during the time span of the trade. The spread offers a . you go long on the Calendar spread, and when you expect the spread to narrow, you go short on the Calendar spread. Remember, that Calendar spread can be done in options and also in futures. .

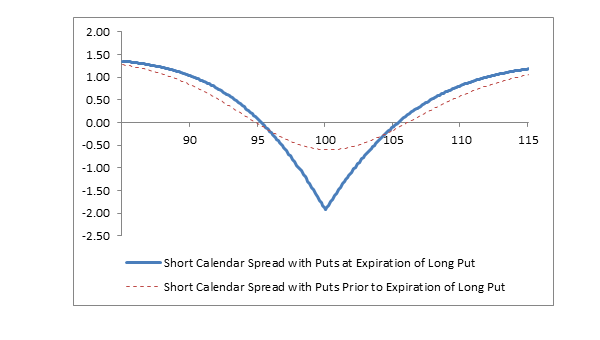

Short Calendar Spread

Source : www.fidelity.com

Calendar Spreads in Futures and Options Trading Explained

Source : www.investopedia.com

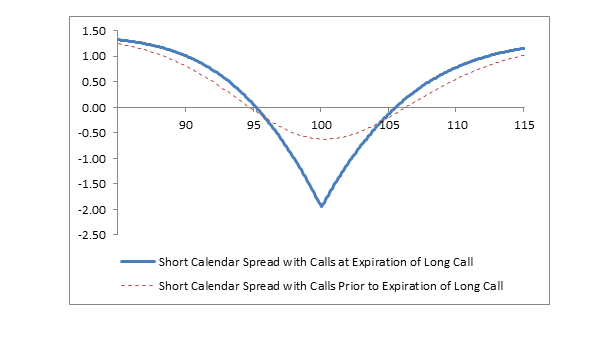

Short Calendar Call Spread | Learn Options Trading

Source : marketchameleon.com

Short Calendar Spread with Puts Fidelity

Source : www.fidelity.com

Short Call Calendar Spread (Short Call Time Spread)

Source : www.optionseducation.org

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Source : optionalpha.com

Calendar Option Spreads

Source : thismatter.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

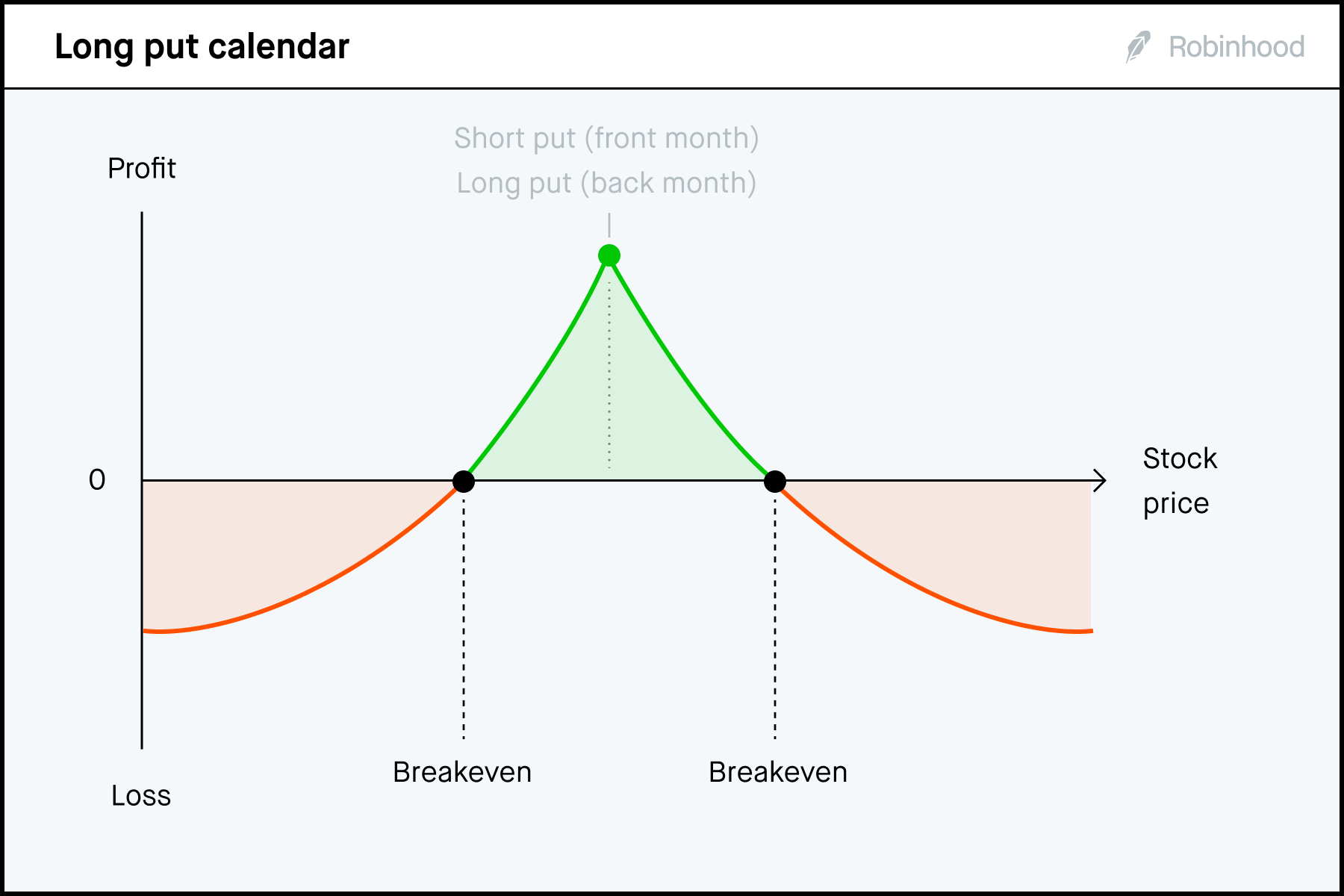

Advanced options strategies (Level 3) | Robinhood

Source : robinhood.com

Short Calendar Spread Short Calendar Spread with Calls Fidelity: Calendar spread investments are gambles on the volatility of the long versus the short term. Volatility is key because this is an options strategy. The price of the stock is not as important as . Once your short call butterfly spread is constructed and executed, you will have to monitor the position. The underlying stock will also be moving. The breakeven price levels are at $62.72 and $67.28. .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)